In its preliminary analysis of the world banana market covering 2019, the Food and Agriculture Organisation of the United Nations (FAO) estimates that the global trade has exceeded 20 million tonnes for the first time, with exactly one third of the volume coming from Ecuador. The second biggest exporter, The Philippines, was projected to reach 4 million tonnes of exports by the end of the year. China has now overtaken Japan as the biggest consumer of Philippines bananas, whilst Ecuador’s exports to China more than doubled.

The FAO states that “production in the Philippines had been affected by a series of adverse weather conditions as well as major outbreaks of TR4 between 2015 and 2017, in response to which significant investments were made in area expansion, disease prevention, new technologies and improved inputs”.

Although China remains a major producer, its net imports have now overtaken both Japan and Russia to establish itself as the third biggest consumer after the EU-28 and the USA. The country accounts for 12% of global dessert banana consumption, with annual imports at well over 2 million tonnes. The FAO reports that “Chinese import demand for bananas continued to be driven by weather- and disease-related disruptions to domestic production as well as fast income growth and associated changes in consumer preferences”.

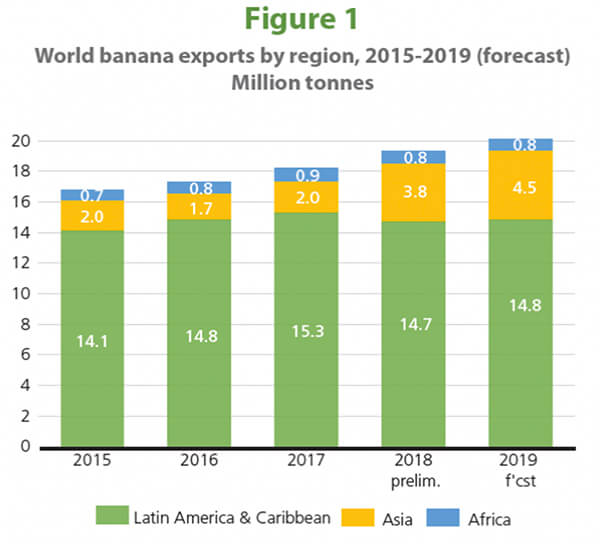

Other countries in the region, notably Malaysia, Vietnam and Laos, are also emerging as exporters. This means that between 2015 and 2019, the importance of Asia in world trade has more than doubled.

Guatemala, which took over recently from Costa Rica as the world’s third largest exporting country, is consolidating this position and, according to US data, accounted for 41 % of all imports to the USA in 2019. In fact, in 2019, Costa Rica had its worst year on recent record because of weather-related productivity issues, whilst Colombia, which increased its productivity and expanded its area, was the fourth biggest exporter, with close to 80 % of all its exports now going to the EU-28.

In Africa, Côte d’Ivoire’s gradual expansion, with investment mainly coming from the French Caribbean, was in contrast to Cameroon’s low export volumes caused by the almost total cessation of exports from the state-owned CDC in the troubled anglophone region of the country. The region’s exports only account for 4 % of world trade.

Source : FAO. 2020. Banana Market Review: Preliminary Results 2019.

Photo: FARMCOOP, Philippines